Businesses across every industry are constantly looking for opportunities to leverage automation to improve their workflow and boost productivity. Unsurprisingly, the narrative is no different in the finance industry.

Research shows that automation accounts for up to 25% of the tasks and processes in the finance industry. On top of that, a further 80% of finance companies are planning to increase their automation adoption. The benefits of this scale of automation have already been felt across industries – 66% of companies have seen an uplift in revenue after adopting AI to automate processes.

Below we take a look at what is meant by automation in finance, and where businesses are finding it to be the most beneficial in evolving their processes and overall efficiency.

What is Finance Automation?

‘Finance automation’ describes the process of using technologies such as machine learning and AI to complete tasks or processes with little to no human input or effort.

By leveraging automated technology, finance teams can free up time and direct their efforts toward achieving more valuable goals and driving strategy. Deloitte articulates that the time saved by automation allows finance professionals to spot optimization opportunities, thus significantly increasing the cash flow, and improving customer experience at all levels.

Rather than act as a complete substitute for human input, the aim is to reduce the amount of joint effort required for financial processes and customer service. The goal of which is to boost efficiency and productivity by automating simple, repetitive tasks.

For instance, imagine having to review and catalog tons of expense reports manually. It would take hours and the results will be prone to error. Instead, AI-powered software can learn from past data sets and use established regulations to automatically flag suspicious expenses, review reports and approve them quicker than a human agent.

Who is Already Benefiting From This Type Of Automation?

Automation isn’t a new trend. In fact, several sectors are already leveraging it to improve internal and external processes. Here are some examples of where financial sectors are adopting automation to improve process efficiency for finance teams and the customers they serve.

Banking

By implementing various automated tools and software, the banking sector streamlines all their financial operations — from records to accounting.

One key area is that of loan applications. Here, banks are increasingly leveraging RPA (robotic process automation) to quickly collect information from loan applicants (oftentimes using chatbots). It’s also possible to use automated procedures to verify IDs and check credit history.

Insurance

The insurance industry has also leveraged finance automation to reduce costs and boost the efficiency of their finance operations. For example, many insurance companies adopt automated claims processing.

In these cases, optical character recognition (OCR) can be used to recognised and interpret handwritten claims submissions. Other times, insurance chatbots are used to collect claimaint information and then guide them through the submissions process.

Accounting

Accounting departments can use chatbots to guide people through the process of tax returns, answering questions and minimizing the risk of incorrect returns being filed. In larger corporations, chatbots can also be used to field questions from other departments relating to payroll, pay dates, expenses and pending invoices. As a result 54% of auditors comprehended faster customer services due to technology like AI and machine learning.

Automation in Finance: 5 Customer Service Use Cases

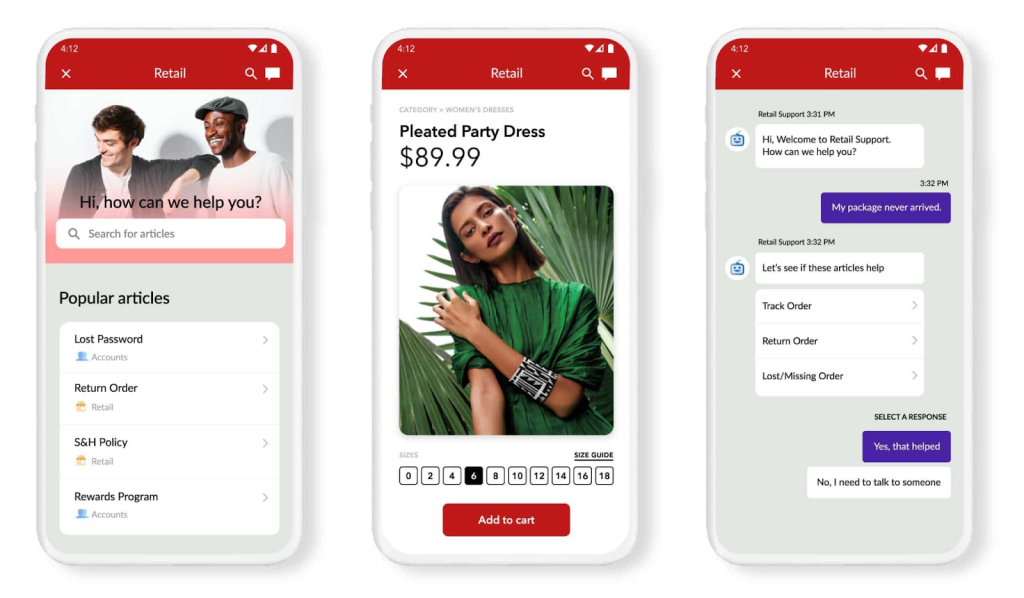

With self-service on the rise, AI automation has become increasingly important for customer service teams working in the finance. In particular, chatbots are proving to be one of the most valuable assets.

When a chatbot can guide customers through an intuitive workflow, it’s one of the easiest ways for brands to respond to customer queries, classify issues, and route or escalate problems. In financial industries, chatbot use cases can range from sending bill reminders or balance notifications to resolving important account questions.

The following examples show some of the areas where automated chatbots can add value for customer service, or customer-facing teams, within financial industries

Reimbursement Requests

There are several reasons a customer may request reimbursement from a company. In some cases, it may be for expenses incurred on behalf of the company – for instance, in a health insurance case.

Using chatbots, it’s possible to automate the repetitive tasks involved in payment and reimbursement requests. Instead of manually inputting details, teams can leverage bots to collect pertinent information and facilitate transactions much faster than it would take a human to complete. It also means customers don’t have to wait in line to speak to a human team member in order to resolve their request.

With automated reimbursement requests, customers can receive updates and track the reimbursement request status in real-time.

Account Questions

From balance inquiries to payment confirmations and transaction history, customers will always have tons of questions about their accounts. So, imagine you had to deal with each request manually?

With automation in the finance industry, you can provide your customers with access to a self-service portal or a chatbot to answer less complex account questions, reducing the calls or emails your customer support team gets.

Urgent Account Requests

Sometimes, account requests may be urgent and require immediate attention. Unfortunately, you may not always have a customer account team member available to take such requests immediately. However, finance automation may be able to provide the help that such customers need.

But, in cases where automation can not resolve the issues, your automation tool can be programmed to recognize urgent requests and escalate them to the appropriate person, bypassing waiting time and other protocols. This way, your customers can receive prompt assistance.

Fraud Detection

Security is crucial when it comes to finances – but 61% of fraud losses reported by banks and financial services are due to identity fraud. Automating your fraud detection and customer protection services will improve an organization’s ability to detect and prevent scams

Using bots, it is possible to set up automated alerts for suspicious transactions or fraudulent activity – ensuring customers can take action as soon as possible. These bots can use a customer’s past activity to learn spending patterns and develop a behavior profile. With this knowledge, anything out of the ordinary can be quickly flagged.

Furthermore, AI-powered KYC measures can verify identities and documents, match fingerprints, and even perform facial recognition. By following the data protection policies, AI-based chatbots eliminate security breaches and eventually track fraud in real-time.

Feedback

Getting feedback from customers is vital as it shows your company how you can improve and position yourself better. With automated surveys, you can request and gather feedback from your customers while having to go through the motions of tracking down and interviewing each of your customers.

Having in-app feedback can help to optimize customer services in this ever-changing and unpredictable world, thereby giving their customers greater value. With chatbot-based feedback systems, everything can be automated and localized to one workflow. For example, Helpshift supports you to have bug reports and user insights from inside your own app.

Automation in Wider Finance Teams

Financial operations within a company goes beyond accounting and bookkeeping. By integrating automation into your financial processes, you can create more efficient experiences for customers, increase agility, reduce costs, increase productivity, reduce delays, and minimize business errors.

Here are some finance automation examples for wider finance teams:

Financial Planning and Analysis

Financial planning and analysis (FP&A) involves analyzing financial data and drawing up forecasts to aid and guide business decisions. However, this process can be very time-consuming as it requires going through large volumes of entries.

However, finance automation can significantly reduce FP&A workload if you know how to leverage it. By automating tasks like data collection and reporting, you can cut down your work time and reduce errors.

For instance, having an automated approval processes allows the accounts payable system feeds directly into purchasing or reimbursement workflows to ensure you only process approved invoices. You can then also use automation in finance to integrate customers’ accounts and payable processes with financial planning tools to automatically allocate budgets.

Expense requests

Managing employee expenses can be challenging, especially in larger companies. But, according to Forbes, we have entered the age of automation which may assist customers (and companies) by managing their expenses.

When an organization employs manual processes to manage valuable data about how much is being spent, by whom, and where, then it can often result in hidden costs. But automation enables the finance teams to see where exactly money is being spent. You can streamline the entire expense process to ensure that employees can submit requests quickly while providing the necessary information the team needs to approve.

Why Finance Organizations are Switching to Automation

Will finance be automated or is it already happening? Today, there are several reasons financial organizations are switching to automation.

Cost-Saving

Automating at scale can have a significant impact on operational costs – this can ultimately free up cash flow for higher value investments. Deloitte’s RPA survey suggests companies could save anywhere between 25 – 80% in operating costs by introducing RPA into financial processes.

Efficiency

Automation streamlines many financial processes, thereby reducing the time they would normally require for completion. As a result, finance automation leads to improvements in both operational efficiency and operational productivity. Accenture’s research suggests 80% of financial tasks could be automated, freeing up 60 – 75% of agent time.

Ease of Use

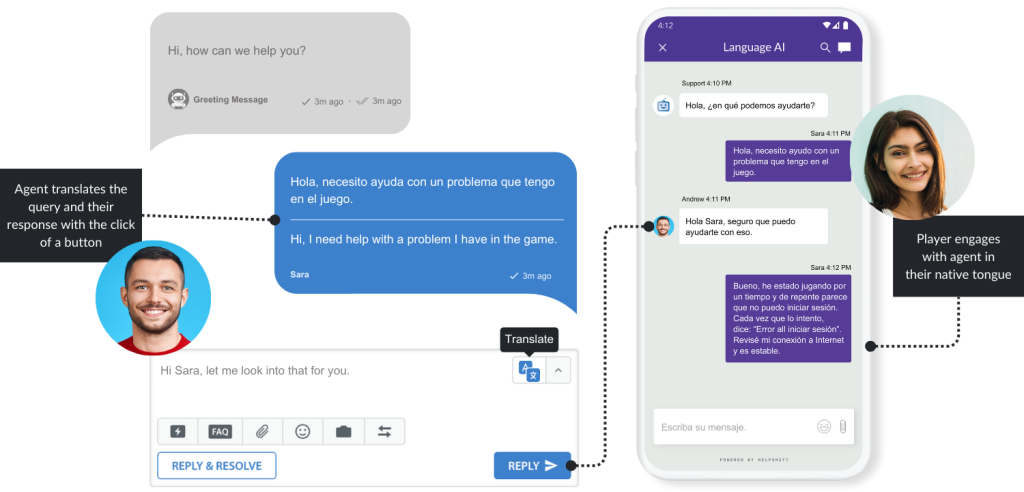

The best automated financial systems are usually designed with intuitive, user-friendly interfaces that makes them easy to set up and use. Easy-to-use platforms ensure can have your bots up and running in minutes without a dev team or programming knowledge. In other words, you don’t have to waste time on extensive training or long onboarding processes.

Accuracy

With human beings, it is almost impossible to eliminate errors. Thankfully, automated systems do not have this shortcoming. With automation in the finance industry, you can eliminate errors and improve the accuracy and reliability of your financial reports. Implementing intelligent automation is improving cash flow forecasts by between 85 – 95% in some industries.

Proactivity

Automated systems such as chatbots can be online and accessible 24/7. As a result, they can proactively keep up with their operations, whether it is identifying potential security issues or processing reimbursement requests even while agents are busy or offline.

Potential Concerns

As with most developing technologies, automation in the finance industry has been met with skepticism from some corners. The main concerns surrounding it relate to perceived security risks and inflexibility – alongside anxieties about replacing human-led interactions with machine-based ones.

Security of Financial Data

Without human-input, automation can create vulnerabilities as it leaves itself open to cyber manipulation and breaches with no backup protocol. Naturally, financial data is some of the most sensitive, which has led to anxieties surrounding implementing automation technology to handle it.

Inflexibility

Although automation can be a significant help with creating a more agile approach to financial processes, one fear holding back mass adoption is the perception that these processes also become less readily changeable without investment in additional technology.

Upfront Investments

One big concern also relates to the investment of both time and money. Automated solutions that aren’t out-the-box require more training and set up costs upfront. For some organizations the to ROI of automation isn’t clear enough to justify these out-right expenses.

Replacing Human Interactions

Concerns surrounding automation are sometimes due to the perception that it will entirely replace human-led activities. While automated financial processes bring a whole selection of benefits, an over-reliance on this technology could ultimately cause problems. Without human input, this technology will be more vulnerable to cyber attacks and can lead to a low ROI because it results in poorer customer experiences.

So, looking ahead, it’s clear that the most beneficial way of leveraging automated technology will be to use it in combination with human-input.

How is Automation Changing The Industry?

Aside from the benefits mentioned above, automation is having a winder impact on the role of finance professionals and teams working in a financial institution. Responsibilities are starting to evolve as technology does, with teams now having to negotiate how to work in conjunction with automated processes.

As a result finance professionals are finding their role is becoming less focussed on transactional activities and more concerned with interpreting data and providing insights. Similarly for financial customer service teams, their role is shifting away from administrative duties (collecting issue information, asking for feedback and routing problems) and towards more value-add activities.

As Deloitte outlines, while innovation in the space continues, it is important for financial organizations to create a balance between human and automation-led processes in order to maximize customer experiences. Having both competencies helps with future-proofing but also ensures the right level of agility and security for the customer base.

Is Automation the Future of Finance?

Nowadays, brands are increasingly looking for innovative ways to meet growing customer expectations and remain relevant.

Customers have increasingly high expectations when it comes to service levels. Corporate and individual expectations are the driving force finance automation, and are ultimately why organizations are certain that they will benefit from it.

By automating core processes such as accounts payable, tax compliance, accounting, invoicing and receivables, payroll, and expense management and more, teams are already finding they are able to relieve financial stress and save time.

For customers, however, AI automation through chatbots is ensuring the accuracy and steadiness of financial information and guidance. The result is more streamlined operations, which then translates into better customer retention. Despite some concerns over the inflexibility of automated procedures and potential drawbacks of decreased human to human interaction, it’s clear that automation is on the rise.

With all this in mind, if you’re wondering if finance will be automated in the nearest future, it is safe to say yes.